Credit cards are designed to extract the maximum amount of interest charges from you. The interest rates are typically high and they encourage you to stay in debt for as long as possible by requiring only a small minimum payment each month. This minimum payment is virtually all interest and very little goes towards the principal so that way you don’t pay the debt down and you are in debt for a much longer period of time. For many high interest rate cards the amount you will end up paying for an item if you only make minimum payments will be more than double the original cost!

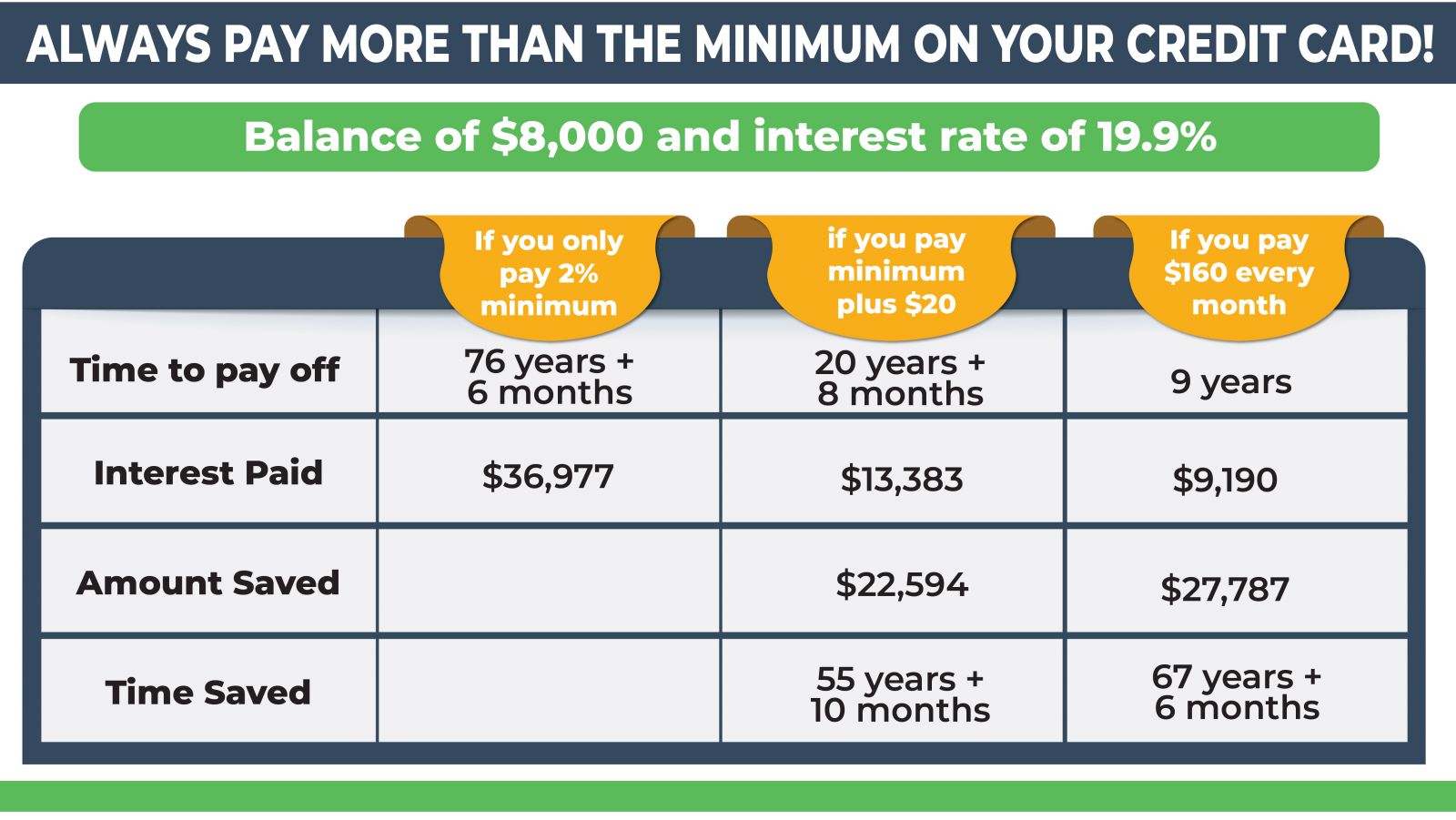

Any additional payment amount you make on top of the minimum payment will all go towards the principal balance and will save you huge amounts of interest. For example if you have an $8,000 balnace on your card that carries an interest rate of 19.9%, the minimum payment at 2% is only $160 per month. If you only pay the required minimum payment each month you will end up paying a total of $37,000 in interest costs!

If however you pay the minimum payment of 2% plus a measly extra $20 each month, your total interest costs will only be $13,383, which will save you over $22,000 in interest costs!

Even better if you make a consistant fixed payment of $160 each and every month, the total interest costs will be reduced to $9,190, which is a savings of $27,787 in interest costs!

To save yourself a huge amount of interest, always pay more than the minimum and as much as you can on your credit card balance as soon as you have the funds.